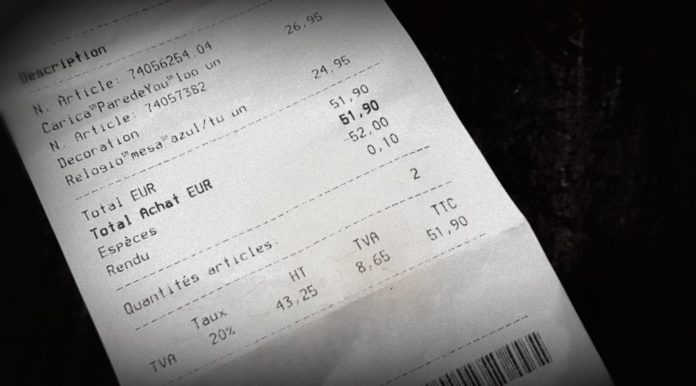

France’s refund rate is 12% of purchase amount, with a minimum purchase amount of 175.01 EUR per receipt. Pharmacy goods, food and books have reduced VAT rates. Cash refund rate for Premier Tax Free is around 10.8%. You need to be older than 16 and have permanent residence in a non-EU country to be eligible.

Additionally, How do I get a refund from Paris tax? How to qualify in 4 easy steps:

- Request a duty-free form at the time of purchase. …

- Prior to checking in, take your tax refund document to the Customs Office for validation. …

- Pick up your VAT cash reimbursement at the Cash Paris* office. …

- Take advantage of the airport’s duty-free shops.

Can I get VAT refund in Paris? If your primary residence is in a non-EU country, you may be eligible for a refund of the VAT on the price of goods you purchased in France. French Customs is in no way responsible for reimbursing the VAT paid on purchases made in France. Only the retailer from whom you purchased the goods can do so.

Subsequently, How do I get a Tourist VAT Refund? Tourists will receive their refunds through a special device placed at the departure port – airport, seaport, or border port – by submitting the tax invoices for their purchases from the outlets registered in the Scheme, along with copies of their passport and credit card.

FAQ

How can I get free tax in Paris?

To be entitled to a tax refund, you must present the duty-free slip at customs on leaving France. You may be asked to produce the objects purchased so that they can be verified. You can easily obtain an electronic duty-free slip by using the Pablo terminals at the airports.

Where is the tax refund at Charles de Gaulle airport? Location description: Cash Paris Tax Refund is located in Hall 6, Level 2, close to Customs ground floor. Get up to 1 000 euros of refund for Domestic and non-Domestic Global Blue Forms.

Can British Get Tax Refund in France? To get a VAT refund in France, you need to have a permanent address outside of France and the EU so if you’re visiting from the UK, you’re good to go! Just make sure your stay in France is less than 6 months and depart back into another non-EU country.

What Can You Get Tax Refund on? Here are 10 of the most under-claimed (but legitimate) tax deductions:

- Car expenses. Often forgotten, these costs quickly add up. …

- Home office running costs. …

- Travel expenses. …

- Laundry. …

- Income Protection. …

- Union or Membership Fees. …

- Accounting Fees. …

- Books, periodicals and digital information.

How do I claim duty-free tax back?

How to get a VAT refund

- Get a VAT 407(NI) form from the retailer. …

- Complete the VAT 407(NI) form. …

- Show the goods, the completed form and your receipts to customs at the point when you leave Northern Ireland or the EU.

- Customs will approve your form if everything is in order.

How long does tax refund take France? Many people think the tax refund will go back on their credit card immediately. This is not the case, the refund process will take up to 3 months.

How do I claim back Eurostar tax?

How to get tax-refund in Gare du Nord in Paris, France Eurostar…

- Step 1: Enter ticket gates. …

- Step 2: Go through customs. …

- Step 3: Go through security checks. …

- Step 4: Using Wevat – follow détaxe signs (tax refund) to arrive at the kiosks!

Do tourists pay VAT in UK? Credits: Nick Howe. Value-added tax (VAT) is a 20% sales tax charged on most goods in the UK. Visitors from outside the EU were eligible for tax-free shopping until January 2021. Tax-free sales at airports, ports and Eurostar stations have now ended as of 1 January 2021.

What is VAT refund at airport?

Initially, only purchases made by tourists from big retailers would be eligible for Goods and Services Tax (GST) refunds at the airports when the tourist is leaving the country, an official said. In several countries VAT or GST are refunded to the tourists for purchases made beyond a prescribed threshold.

Can I get duty-free in France?

When entering France/EU

You are allowed to bring back in France/EU the following amount of duty/tax free goods, provided you travel with the items and do not intend to sell them (if you go over this allowance, you may have to pay duty and/or tax) : 200 cigarettes or 100 cigarillos or 50 cigars or 250g of tobacco.

When can you claim tax 2021? When can I file my tax return? The official end of the 2021 financial year falls on Wednesday 30 June 2021. That means that you can begin lodging your tax return from Thursday 1 July 2021.

When can you claim tax 2022? 15 May 2022

If you’re an individual and used a registered tax agent to help lodge your annual tax return for the fiscal year 2021 (1 July 2020 – 30 June 2021), this is typically the deadline they will adhere to for the submission of your return.

Do I get all my tax back if I earn under 18000?

You earned less than $18,200, but paid tax on your income

Even though you earned under the new tax free threshold, as you paid tax on your income during the year, you should lodge a tax return. In this situation it’s likely you may get all of the tax you paid throughout the year back after you lodge your tax return.

Can I claim tax back at airport? You may be eligible to claim a refund on tax paid on goods within Australia as you pass through the airport. Refunds are given to passengers who have spent $300 or more (including tax) in the 60 days before their departing flight. Goods must be carried on board and presented together with a tax invoice.

Who can claim VAT back at airport?

You are eligible for a VAT refund if: You normally live outside the EU. You are an overseas resident but have been working/studying in the UK. However, you will need to prove that you are leaving the EU for more than 12 months.

Can foreigners claim VAT back? Under the VAT Retail Export Scheme (VAT RES), international visitors to the UK can reclaim the VAT they pay on goods purchased but not consumed in the UK.

How much is tax in Paris?

In France, the Value Added Tax for most goods and services you are likely to buy is 20%. That’s the amount automatically added to most purchases including restaurants, hotels, and consumer goods. The good news is you can get back the VAT with the proper paperwork and some advance planning.

Can British get tax refund from France? To get a VAT refund in France, you need to have a permanent address outside of France and the EU so if you’re visiting from the UK, you’re good to go! Just make sure your stay in France is less than 6 months and depart back into another non-EU country.

How do I claim my refund from Geneva airport?

Tax refunds

- Check-in.

- Go to the reserved area, the top floor, follow the “Détaxe / tax refund” signs. If refund is requested in cash on the form => go to the Global Exchange counter.

Is there duty free at Eurostar Paris? Is there duty free at Gare du Nord (or Paris Nord, “North Station”) Eurostar terminal? It’s a commonly asked question on the internet, so let’s set the record straight. No, there isn’t.

Can you get VAT refund after leaving Europe?

Can you get a VAT refund after leaving Europe? Yes, you have to leave Europe to claim your VAT refund. If you merely cross a border within the European Union, you won’t be eligible: the items have to leave the taxable area, not just the country where you purchased them, in order to count as an export.

Which country is tax free? Monaco: The tiny European city-state imposes zero tax on citizens income. Qatar: Another oil-rich Arab kingdom on the list is the tiny nation located on the Persian Gulf. Saint Kitts and Nevis: The tropical island nation situated between the Atlantic Ocean and the Caribbean Sea is another nation with no income tax.

Do you pay VAT on a refund? Normally if you make a compensation payment to an unhappy customer, it’s outside the scope of VAT. In other words because it doesn’t relate to a supply of goods or services it shouldn’t affect your VAT bill.

Don’t forget to share this post !