Calculating the VAT Amount

So to calculate the VAT on any purchase price, we need to multiply the price by the VAT percentage. For a purchase price of x, we multiply x by 15%. But recall that 15% means 15 per 100 or 15/100. So the VAT amount on x is simply x multiplied by 15/100 = (x)(15/100).

What is VAT not included? VAT stands for « value added tax. » It’s similar to our sales tax in the U.S., although a good bit higher. When you see a price quoted as « VAT included, » what you see should be what you pay, with no other tax added on.

Then, How is the VAT calculated? VAT-inclusive prices

To work out a price including the standard rate of VAT (20%), multiply the price excluding VAT by 1.2. To work out a price including the reduced rate of VAT (5%), multiply the price excluding VAT by 1.05.

How do you calculate cost price? CP = ( SP * 100 ) / ( 100 + percentage profit).

FAQ

Does net of VAT include VAT?

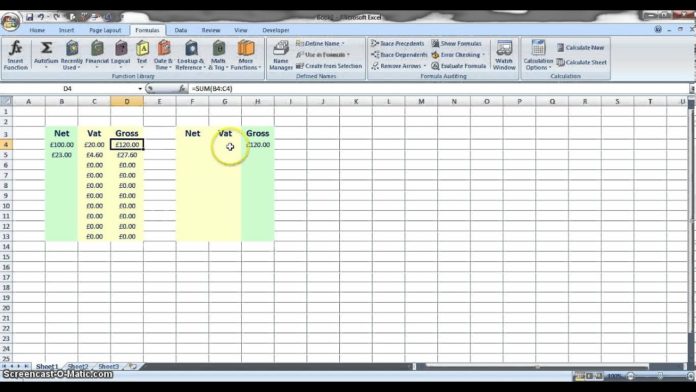

We started the calculation with the net amount, which doesn’t include the VAT, so is a VAT exclusive figure. We then calculated 20% of it to tell us how much VAT was chargeable. By adding the net and the VAT we calculated the gross amount. This is the invoice total that the customer will pay.

How is VAT different from sales tax? Sales tax vs.

Until the sale is made to the final consumer, sales tax is not collected, and tax jurisdictions do not receive tax revenue. VAT, on the other hand, is collected by all sellers in each stage of the supply chain. Suppliers, manufacturers, distributors, and retailers all collect VAT on taxable sales.

What are the 3 types of VAT? VAT: The difference between standard-rated, zero-rated and exempt supplies. There are three categories of supplies that can be made by a VAT vendor: standard-rated, zero-rated and exempt supplies.

How is VAT calculated? VAT-inclusive prices

To work out a price including the standard rate of VAT (20%), multiply the price excluding VAT by 1.2. To work out a price including the reduced rate of VAT (5%), multiply the price excluding VAT by 1.05.

Is VAT included in price UK?

VAT is normally included in the price you see in shops, but there are some exceptions.

Is VAT shown in profit and loss? If you are VAT registered, your income and expenses are likely to be shown ‘net’ of VAT, i.e. any VAT charged/ incurred is not included in the profit and loss account. Also, the profit and loss account only shows ‘revenue’ transactions that are connected with the commercial activity of the business.

How is business VAT calculated?

Divide gross sale price by 1 + VAT rate

For example, if the applicable standard VAT rate is 20%, you’ll divide the gross sales price by 1.2. If the applicable VAT rate is 5%, you’ll divide the gross sales price by 1.05.

What is included in cost price? A cost price includes all outlays that are required for production, including property costs, materials, power, research and development, testing, worker wages and anything else that must be paid for.

What is cost price and list price?

cost price (also known as sales price). The list price is simply the price that an item is listed to be sold for. For instance, if you run a T-shirt shop, the list price of a pink shirt might be $24.95. … A sales price can is simply as what the item actually sells for.

What is the different between cost and price?

Cost is typically the expense incurred for making a product or service that is sold by a company. Price is the amount a customer is willing to pay for a product or service. The cost of producing a product has a direct impact on both the price of the product and the profit earned from its sale.

Does gross selling price include VAT? All goods and properties (except those specifically exempt), including those subject to excise tax, sold, bartered or exchanged are subject to a 12% VAT based on the gross selling price152 or gross value in money.

Does gross price include tax? Gross as an adjective can be defined as “without deductions; total, as the amount of sales, salary, profit, etc., before taking deductions for expenses or taxes.” Or as a noun, gross refers to the total income from sales, or salary before any deductions.

Is VAT and tax the same?

VAT is a tax which is ultimately paid by the consumer, and is not a tax on individual businesses. While businesses pay VAT to Her Majesty’s Revenue and Customs (HMRC), the actual cost has already been paid by the customer, covered by the purchase price of goods or services bought.

How much is VAT tax in UK? The standard rate of VAT in the UK is 20%, with about half the items households spend money on subject to this rate. There is a reduced rate of 5% which applies to some things like children’s car seats and home energy.

Do businesses pay VAT on purchases?

While VAT registered businesses charge their customers VAT on the products and services they sell, they also pay VAT on the products and services they buy, such as raw materials, professional services or stock.

Is VAT a UK tax? VAT is an acronym for Value Added Tax and was introduced in the UK in 1973. It is a tax that is applied to the purchase price of certain goods, services and other taxable supplies that are bought and sold within the UK.

Who is paying VAT?

If the seller is registered for VAT purposes, the purchase price will include VAT, which is payable on transfer by the seller. If the seller is not registered for VAT purposes, then transfer duty is payable by the buyer.

How much is VAT in UK? VAT rates for goods and services

| % of VAT | What the rate applies to | |

|---|---|---|

| Standard rate | 20% | Most goods and services |

| Reduced rate | 5% | Some goods and services, eg children’s car seats and home energy |

| Zero rate | 0% | Zero-rated goods and services, eg most food and children’s clothes |